- News

- RBI’s board reviews its capital framework

RBI’s board reviews its capital framework

Reserve Bank of India is reviewing its economic capital framework. This review could alter how RBI calculates dividends to the government. The central board of directors will discuss the matter. Economists anticipate a substantial dividend transfer to the government. The Bimal Jalan Committee's recommendations are under scrutiny. The review aims to ensure the framework's continued relevance.

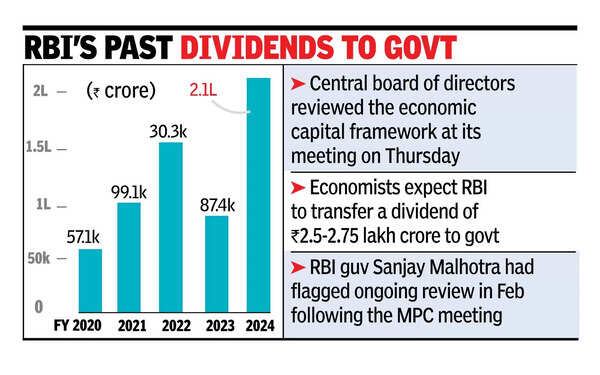

MUMBAI: The way RBI calculates the dividend it pays to govt may soon change, with the central board of directors reviewing the economic capital framework at its meeting here on Thursday. The meeting was chaired by governor Sanjay Malhotra and comes five years after the Bimal Jalan Committee’s recommendations, which form the basis of the current framework.Economists expect RBI to transfer a dividend of Rs 2.5-2.75 lakh crore to govt, owing to record profits from selling dollars from its reserves at high margins following the rupee’s depreciation in the second half of FY25. While these earnings were booked in FY25, the dividend will be paid out in the current fiscal. RBI typically transfers the dividend in the last week of May.The Jalan Committee’s 2019 report recommended including revaluation balances in RBI’s risk buffers but limiting their use to cover market risks, recognising their inherent volatility. It also proposed that the surplus distribution policy should factor in both total economic capital and realised equity to ensure a balance between overall capital and the more stable portion of reserves.

RBI's past dividends to govt

Stay informed with the latest business news, updates on bank holidays and public holidays.

AI Masterclass for Students. Upskill Young Ones Today!– Join Now

End of Article

Follow Us On Social Media